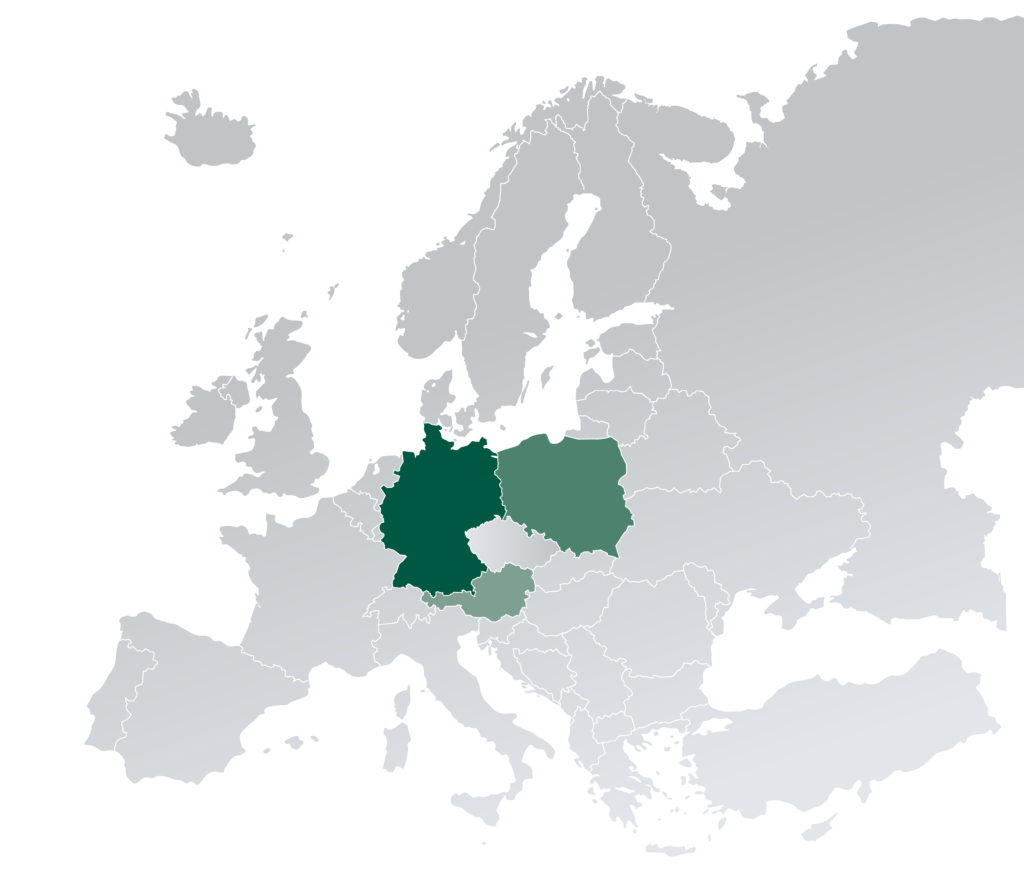

One-Stop-Shop for Real Estate Investments in Germany, Austria and CEE.

OUR INVESTMENT APPROACH

In-House Strategy

- Core, Core+, Value Add, Opportunistic

- Customizable Funds, Mutual Funds and Separate Accounts

- Full life cycle management:

Transaction Management → Assets Management → Portfolio management

Asset Management-Partner-Strategy

- Use of proven, local, specialised AM-Partners: Selection of “Best in Class”

- Asset classes subject to market and cycle opportunities

- Investment styles focus on Core to Opportunistic

OUR EXPERTISE

Our goal is to reduce the investors risk profile and optimize assets to increase returns.

We provide a transparent view of the real estate portfolio through the use of data analytics, to track activity and monitor performance. Our service offerings include the structuring and management of regulated products, for which we use strategic partners.

We maximize the appreciation potential of your real estate investments through active asset management, as we specialize in particular types of property, regions, or operations.

We focus on optimizing the performance of assets, revitalizing and repositioning of assets, and providing first-class property management.

Co-partner Pegasus Capital Partners (Pegasus) is the “preferred partner” for construction work on existing properties of KINGSTONE IM’s funds. Pegasus has its own architects, construction engineers and project developers who can handle the entire value chain in-house. Pegasus has many years of experience with established partners and a solid network of general contractors with whom it has worked for years in a spirit of trust.

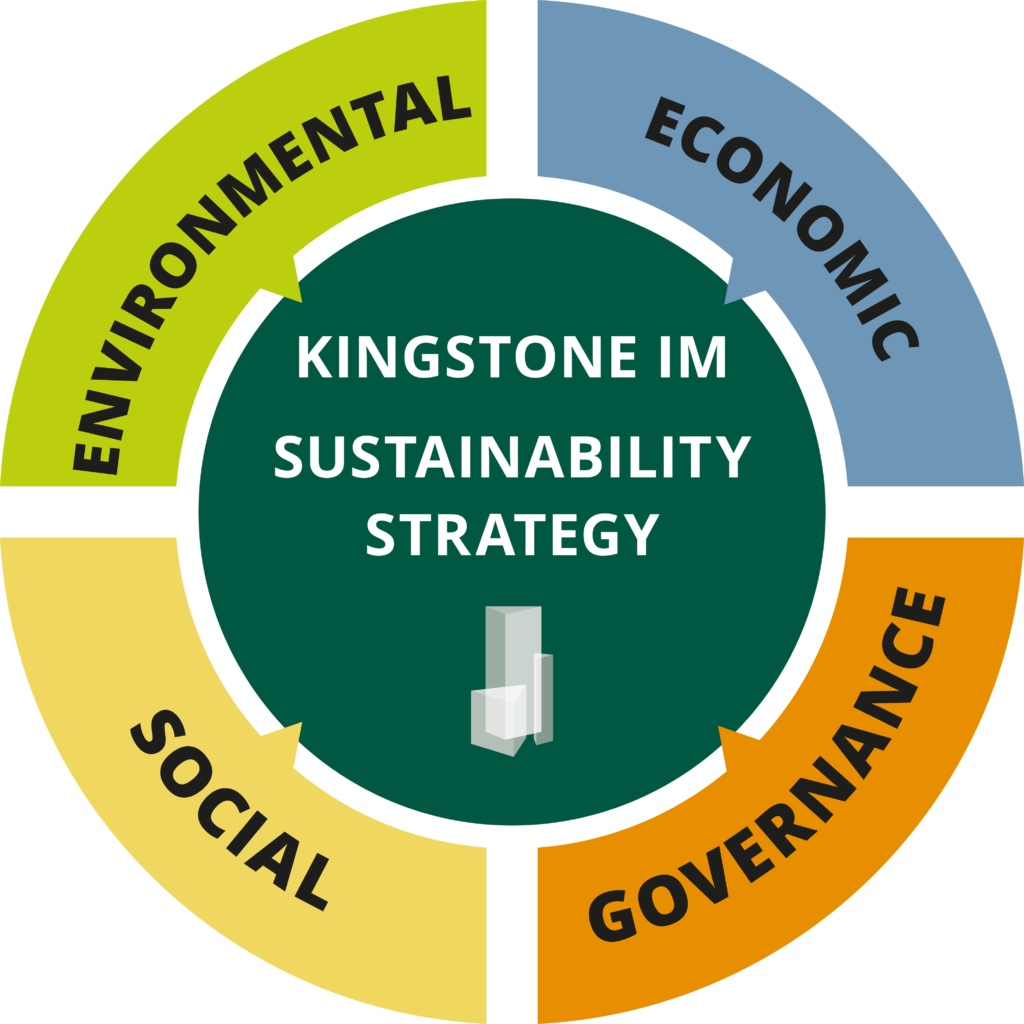

SUSTAINABILITY

INVESTMENT OPPORTUNITIES

Commingled Funds

KINGSTONE Wachstumsregionen Süddeutschland

Open-ended Special AIF

KINGSTONE Wachstumsregionen Süddeutschland II

Open-ended Special AIF

Separate Account of a German Bank Institution

Open-ended Special AIF

Fund Vehicles & Separate Accounts in Germany, Austria and Eastern Europe

KINGSTONE IM offers institutional investors real estate investments in Germany, Austria and Eastern Europe as risk-adjusted and long-term oriented product solutions. These are issued as special funds according to KAGB.

We develop innovative strategies to achieve the investment objectives of our clients' real estate investments. Each strategy is tailored to the property type, geography, target return, risk and liquidity needs. With our expertise and extensive experience in managing portfolios, we regularly exceed our investors' goals.

At the same time, we facilitate reliable deal sourcing through an excellent network in Germany, Austria and Eastern Europe.

Real Estate Debt

Our platform KINGSTONE Debt Advisory designs innovative in-house investment solutions with a focus on real estate debt. Investments are made in whole loan and mezzanine financing. We offer a broad range of investment products and a holistic investment approach for institutional investors.

Sarah Verheyen

Head of Portfolio Management

E: s.verheyen@kingstone-da.com

Markus Mayer

Head of Client Capital Germany

E: m.mayer@kingstone-da.com